On May 16th, thousands of New York City homeowners whose budgets are already stretched thin could face an additional financial burden. Homeowners who are behind on their property taxes or water/sewer payments, or those who’ve had emergency repairs made by the City, may see those debts sold to a third-party collection agency. Once a tax lien is sold, the collection agency adds fees and high interest on top of the original debt. Paying the debt can become overwhelming and unpaid debts may eventually lead to foreclosure.

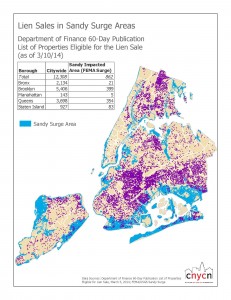

More than 12,000 homes are on the Department of Finance’s 60-day Tax Lien Sale list. More than 850 of these homeowners were in neighborhoods hard hit by Hurricane Sandy. Many of these New Yorkers are still reeling from Sandy and they will face a whole new challenge if their tax liens are included in the sale. Although the Department of Finance sends 90, 60, 30, and 10 day notices about the sale to all property owners on the list, homeowners may not be aware of the full implications of having their tax liens sold.

The Department of Finance, in collaboration with the Department of Environmental Protection and the Department of Housing Preservation and Development, organizes outreach events to help homeowners in the five boroughs. Many City Council Members and other elected officials co-host these and other events across the city. At the events, homeowners can enter into payment agreements and apply for exemptions. Seniors, people with disabilities, veterans, and those on active military duty can be removed from the tax lien sale list by submitting the Exemption Eligibility Checklist or Military Request for Relief by May 15th. Those not in an exempt category can enter into a payment plan of up to ten years with the City by May 15th. Payment agreements with the City are more affordable than payment agreements with collection agencies and the City’s interest rates are lower than those charged by collection agencies.

Many of the Center’s Network Partners have been helping homeowners avoid the tax lien sale by getting the word out about the sale and the implications of being included in it. Many of our partners are also providing detailed financial and legal advice on individual homeowner’s circumstances. We’re partnering with City agencies and Council Members by participating in their outreach events. Our network will be on-site at many of these events with staff who are able to provide homeowners with one-on-counseling to assist with complex tax lien issues, as well as with overall household affordability challenges, including mortgage issues.

For help with obtaining a payment agreement or completing exemption forms, please call 311 to be connected to the Department of Finance. You can also visit nyc.gov/liensale to find outreach events near you.

For one-on-one housing advice on complex tax lien issues or other household finance questions, please call 646-786-0888 to be connected to a housing advisor in our network.