According to a recent New York Times op-ed, “Debt and the Racial Wealth Gap,” we as a country are facing the widest racial wealth gap since 1989. Today, the median wealth of white families is 13 times the median wealth of black families. In the op-ed, Paul Kiel of ProPublica examines the historical roots behind racial disparities in household wealth and how this impacts the ability of families to respond to financial emergencies.

For African American families, the causes of this disparity lie well beyond the most recent recession: during the World War II housing boom, the federal government blocked African American families from accessing federally-backed loans, preventing them from accessing the same opportunities to purchase homes, make repairs, and accumulate wealth as white families.

More recently, the homeowners the Center for NYC Neighborhoods serves and the communities where we work continue to reel in the impacts of the 2008 foreclosure crisis and the recession it caused. These impacts are not felt equally: even when accounting for income, African Americans were disproportionately targeted for subprime and other loans that are more likely to lead to foreclosure. As a result of the foreclosure crisis and the recession that ensued, half of the collective wealth of African-American families was lost.

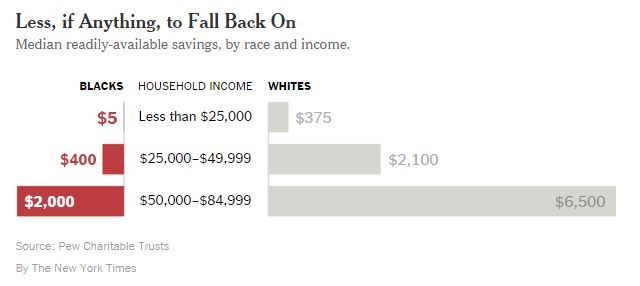

The racial wealth gap means that African-American families have less financial reserves than white families and thus are disproportionately affected by financial crises and setbacks. In a 2013 federal survey, roughly one-quarter of African-American families had less than $5 in reserve to draw from in case of emergency. Any small change in monthly expenses could set off a catastrophic pile-up of fines and debts. This graph shows the difference in available fall-back reserves between African-American and white families based on household income:

One of our core values at the Center for NYC Neighborhoods is that affordable homeownership is about equality. We believe the opportunity to own a home shouldn’t be out of reach for middle- and working-class New Yorkers. Discrimination in affordable housing contributed to the creation of the modern racial wealth gap and affordable homeownership policies must confront the increasing divide of income inequality nationally and an ever-hotter real estate market locally. The opportunity that homeownership can create is extraordinary — we’ve already built much of the infrastructure to make it possible, and we must work to preserve it. At the end of the day, it’s simple: helping families build equity in their homes makes our country more equitable.