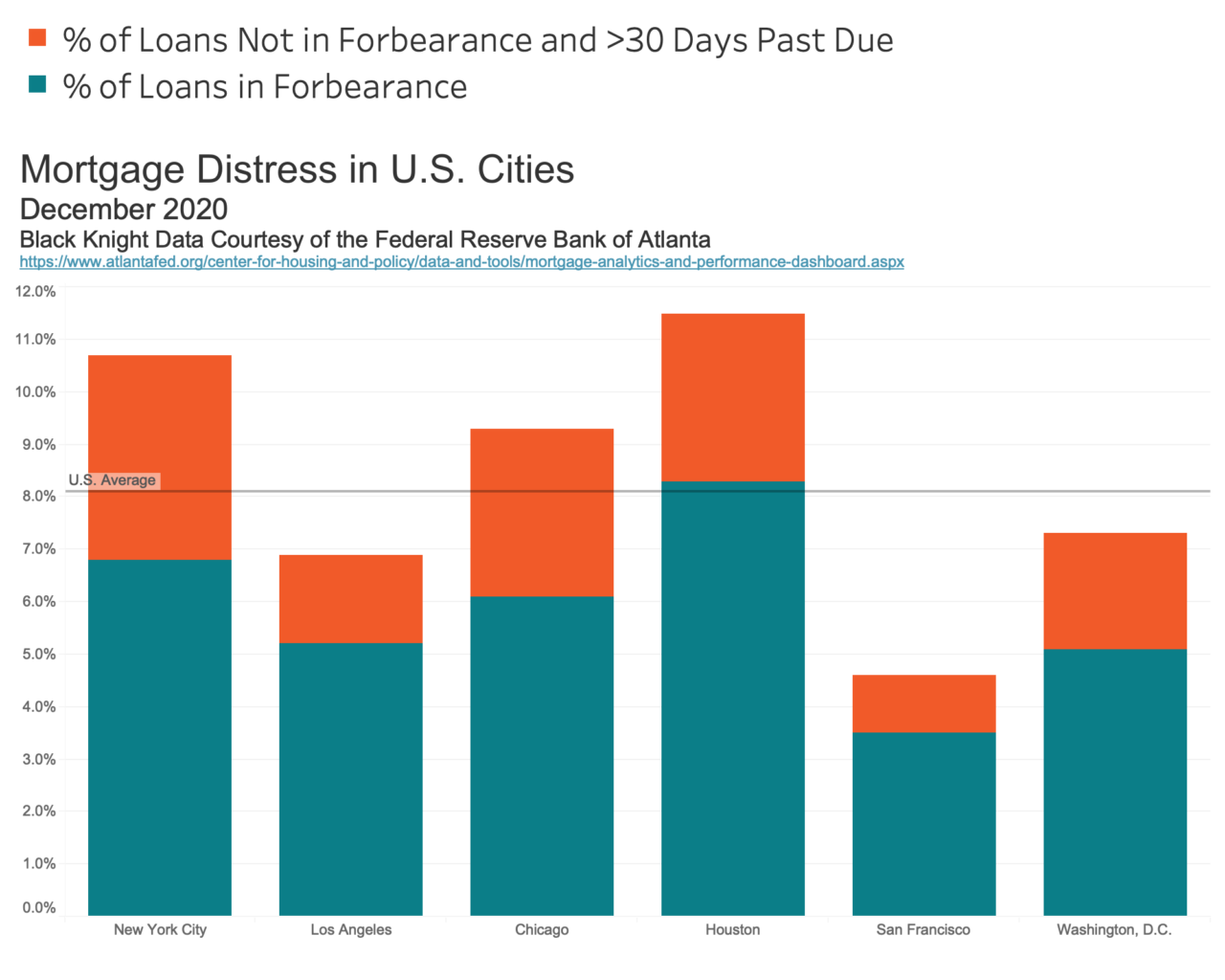

New York City has significantly higher levels of mortgage distress than the rest of New York State, according to the Federal Reserve Bank of Atlanta. We estimate there are approximately 75,000 New Yorkers at risk of foreclosure in the coming year. This estimate includes New York City borrowers in forbearance and those not in forbearance but more than 30 days overdue. It’s hard to know for sure because there are moratoria on foreclosure filings.

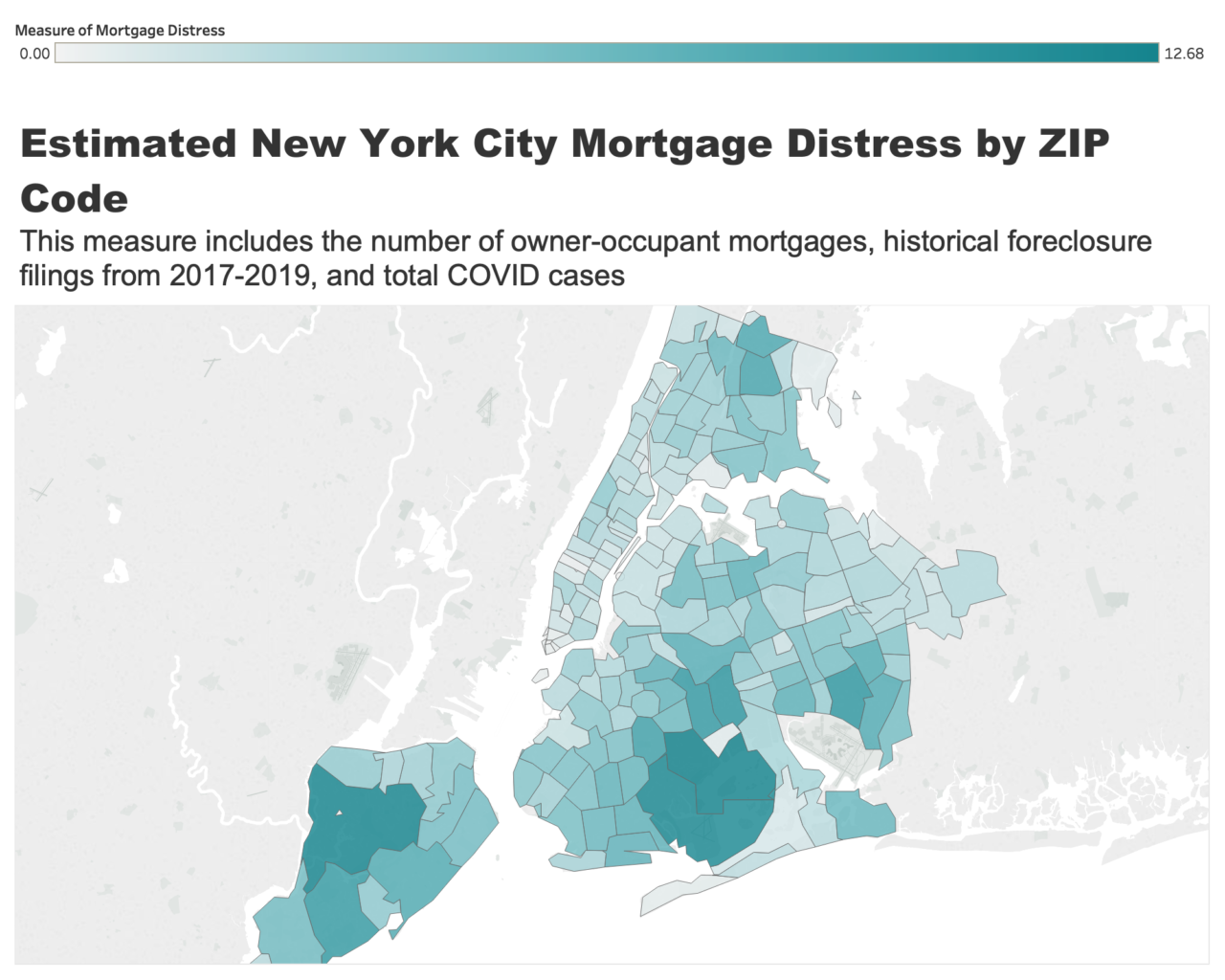

As of December, Queens, Brooklyn, and the Bronx had significantly higher levels of mortgage forbearance as well as higher percentages of mortgages not in forbearance but more than 30 days past due.

These data demonstrate that when forbearances and the federal and state foreclosure moratoria end, a massive swath of homeowners face the prospect of foreclosure. COVID-19 and the resulting job losses have left thousands of families in precarious financial situations. While the pandemic slows in New York City, the economic effects will last far longer. As of March 2021, New York City’s unemployment rate stands at 11.2%, far higher than the state rate of 8.5% and nearly triple the city’s rate in March 2020 of 4.2%

Funding for housing counseling and legal services is critical to ensure that New York City homeowners have assistance. The Center for NYC Neighborhoods has requested $4 million for citywide foreclosure prevention (Tracking number 104128) to serve an additional 1,500 households.

The Center anticipates that these funds can be used to help homeowners coming out of forbearance to negotiate equitable modifications with mortgage servicers to help keep homeowners affected by COVID-19 in their homes. Without these funds, our experience has shown that homeowners are often forced into post-forbearance terms favorable to the mortgage servicers, such as balloon payments and increased monthly mortgage payments, which can force families out of their homes over the long term.