Thousands of homeowners in the five boroughs may be surprised to know their outstanding debts to the City will soon be sold to private investors. The City’s annual tax lien sale on May 12, 2016, can be lucrative for both the government and investors — but it can also be devastating for many homeowners.

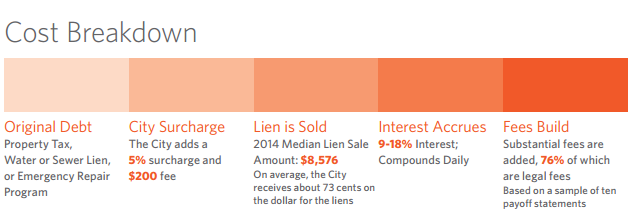

Purchasers of tax liens can tack on fees and levy daily compounding interest rates of up to 9% for properties worth less than $250,000 or up to 18% for more expensive properties. For the City, the sale is a quick way to raise cash.

Yet for homeowners, initial debts as small as $1,000 — from unpaid property taxes or water charges, or emergency repairs — can blossom into much more burdensome amounts that can spiral out of control. If a homeowner is unable to pay, the purchaser of the lien can even foreclose and sell off the property at auction.

In 2014, 2,729 tax liens were sold for one-to-three family homes, with an average debt owed of $12,000. But an analysis of tax lien payoff statements submitted to us by Network Partners over several years showed the average amount owed to private investors after added fees and interest was $27,365 — more than double the cost of the initial tax liens in some cases.

The burden is clear for homeowners, as the case of Augustine McDowell of the Bronx demonstrates: After being laid off from his job in 2010, he tried to get by with the rent from his tenants but they too became delinquent on their payments and Mr. McDowell fell behind on water charges. That initial debt of $27,000 was sold off, and by Christmas Eve 2015 it had increased to over $42,000; only an emergency loan from the New York State Mortgage Assistance Program, funded by the New York Attorney General’s Office and administered by the Center, kept him from losing his home to foreclosure.

Related: How to protect your home from the tax lien sale

As McDowell’s case demonstrates, it’s often the unemployed, elderly, or other people at risk financially who ultimately take the biggest hit in the city’s tax lien sale.

Officials with the Department of Environmental Protection testified to the City Council in 2015 that its sale of water and sewer liens generates $100 million in revenue that is essential to supporting its operations. An official with the Department of Finance said that tax lien sales allow the agency to collect unpaid property taxes and charges, and “ensures fairness and equity among property owners.” The agency said it had collected $1.3 billion from tax lien sales since 1996.

The Center, like many members of the Coalition for Affordable Homes, has proposed that so-called tax class one properties (one-to-three unit buildings) be exempted from the lien sale. In 2014, tax class one properties represented $34 million in debts out of a total $115 million. Given the high repayment rate (more than 60% of property owners with liens sold between 2009 and 2011 repaid their debts, according to the NYC Independent Budget Office), many advocates believe that keeping these debts in City payment plans, rather than handing them over to private investors, would keep vulnerable residents like seniors from serious financial turmoil or homelessness.

The tracker below shows where the properties on the 2016 tax lien sale list are located.

But that will still leave thousands of homeowners on the list facing debts they may quite possibly never be able to repay once high interest and fees accrue, which could even put them at risk of foreclosure.