Starting today, homeowners in New York City and across America will see a significant increase in their flood insurance payments when their policies are renewed.

What is happening?

- Most New Yorkers who live in the flood zone will see their insurance rate increase by up to 18%.

- Households whose homes were damaged during Hurricanes Sandy and Irene could see rates go up by as much as 25%.

- Local businesses will see their rates go up by up to 25%.

- Homeowners will also be stuck with a new annual charge from FEMA — $25 for primary homes and $250 for second homes. However, families will automatically be charged the $250 unless they prove their home is their primary residence.

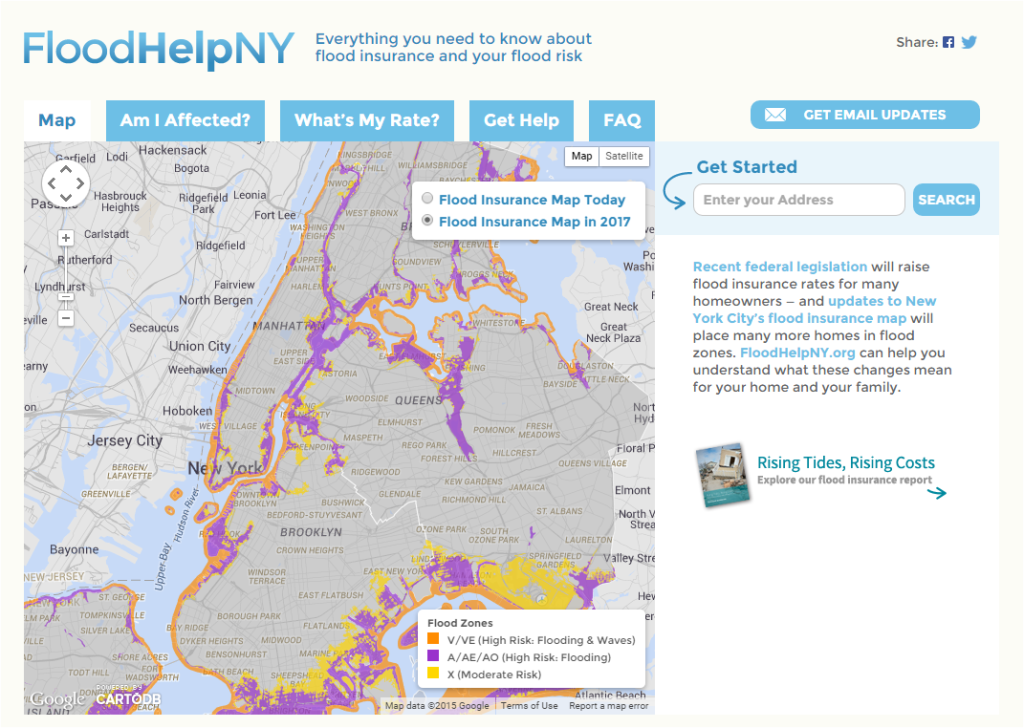

These rising costs are just the beginning, with similar rate increases expected each year. What’s more, FEMA’s new flood insurance rate maps for New York City are anticipated to go into effect in 2017, which will double the number of New Yorkers required to purchase flood insurance, a requirement that will extend to nearly 72,000 properties housing over 400,000 New Yorkers.

What can you do?

- If you see rate increases over 18%, call your broker and ask them to explain the increase.

- If you’re a primary homeowner, make sure you aren’t paying the $250 charge: talk to your agent and submit proof that your home is your primary residence.

- If you have questions about flood insurance and your flood risk, visit FloodHelpNY.org.

- You can also call 646-786-0888 for more information or to be connected to a housing counseling or legal services.

- Help us get the word out! Share our flyer with your network and email us if you would like any printed copies.