Imagine you have fallen behind on your mortgage and received a notice from your bank that you could lose your home. You know you need help, but are unsure where to turn. One day, you get a call from a company offering the help you’ve been looking for. The person on the phone tells you that he can help save your home! His fee is $4,000, but he guarantees that if you pay the fee, you will get an affordable mortgage modification. You decide to go ahead with it.

A few months and several thousand dollars later, you have not yet received your promised modification. You head over to their office to get some answers, only to find a shuttered building with no trace of the organization you’ve been paying for the last few months.

Unfortunately, this scenario is all too common for many New Yorkers. Day after day, foreclosure rescue scammers take advantage of more and more homeowners struggling to keep their homes.

To help combat this problem, the Center released a joint report with the Lawyers’ Committee for Civil Rights Under Law titled, Who Can You Trust? The Foreclosure Rescue Scam Crisis in New York. The report highlights some shocking findings:

- Foreclosure rescue scams are, unsurprisingly, most prevalent in those communities heavily impacted by the foreclosure crisis.

- As of September 2014, New York homeowners have submitted over 2,700 complaints to the Lawyers’ Committee’s Loan Modification Scam Database.

- New York homeowners have been conned out of an average of about $4,200 each, well above the national average of about $3,300.

- Homeowners in New York have reported total losses of $8.25 million.

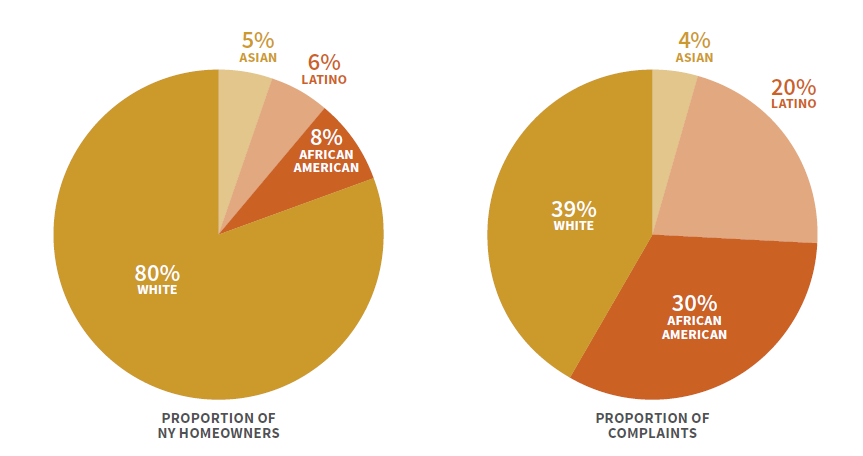

- Foreclosure rescue scammers disproportionately target minority homeowners. African American homeowners make up 8% of homeowners in New York, but represent 30% of reported foreclosure rescue scams. Similarly, Latino homeowners own 6% of homes, but are 20% of reported scams.

At the Center, we’re working to alert homeowners, as well as the trusted community leaders and institutions they turn to for advice, about these scams. Likewise, we want to make sure homeowners know about the high-quality, legitimate services available through the Homeowner Protection Program. By connecting homeowners in need of help to free, high-quality legal services and housing counseling, we can cut scammers out of the equation while maximizing the likelihood that a homeowner will be able to find a home-saving solution.

If you are a homeowner and you think you may be working with a scammer, remember these four signs of a scam.

- Someone “guarantees” a positive result.

- Someone asks you to pay an upfront fee.

- Someone tells you to stop paying your mortgage and tells you to pay them instead.

- Someone pressures you to sign paperwork without fully explaining what you are signing.

If you suspect that you’ve come across a scam, you can report it to the Office of the New York State Attorney General.

To reach high-quality, trustworthy help with your mortgage, call the Homeowner Protection Program hotline today at 1-855-HOME-456 (855-466-3456) to be connect to help – at no cost to you.